De-Dollarisation: Acceleration In 2024?

Wednesday, 10 January 2024By Bob McDowall

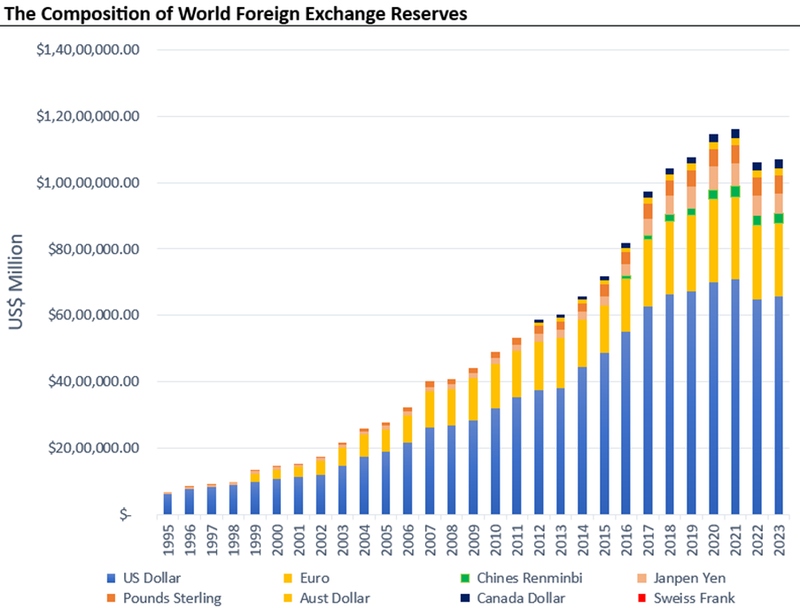

De-dollarisation is the process of moving away from the world’s reliance on the U.S. dollar (USD) as the chief reserve currency.

The dollar has remained the primary reserve currency and conduit for international business ever since the United States emerged as the world’s top economic power following World War II. Can the USD sustain its leadership?

A brief analysis of de-dollarisation at the end of 2023

De-dollarisation is a sensible policy for many nations, which were previously vassals of the US currency and suffered unfortunate and unpredictable consequences as a result. Whether it is the imposition of sanctions that obstruct a country’s access to dollars on international markets, the freezing of a country’s dollar-denominated assets held within Western financial institutions or the banning of a country’s banks from the dollar-denominated SWIFT (Society for Worldwide Interbank Financial Telecommunications) payment system, the enthusiasm to de-dollarise has gathered pace this year as more countries seek to diversify their exposures into alternative currencies and investments.

.

Will de-dollarisation accelerate in 2024?

Global fragmentation is growing. Undoubtedly, geopolitical and geostrategic shifts, including the ongoing Russia-Ukraine crisis, the tensions over Taiwan and the crisis in the Middle East are key drivers in de-dollarisation. These events tend to be accompanied by diminution in trade, weak supply chains and trade sanctions.

The Middle East crisis and the Russian-Ukraine War are ensuring that more sales in the oil market are and will be accompanied by non-dollar pricing and settlement of transactions. Such mechanisms are especially attractive if the alternative currency is pegged to the US dollar.

Global fragmentation is leading to more extensive trade within region, mitigating the transport pricing and logistic challenges of global trading. innovative pricing of transactions within region reduces the prominence of the US Dollar. As the countries of Africa increase their participation in global trade exploiting their mineral and other natural resource reserves, they will certainly be giving deep consideration to currency alternatives to the US Dollar in which to price and transact trade.

The US Presidential Elections in later 2024 has wider dynamics than the routine four yearly Election cycle. Age, physical and character frailties of the leading candidates and the constitutional wrangles, which are accompanying the Primaries in the run up to the Presidential Election reveal a fragility to the USA, which has certainly been absence since before World War II. The jurisdictional and reputational risks of these events have not yet been priced into financial markets but if and when they are, the effects could cause further reflections on de-dollarisation.

More prescient will be the impact of the new President’s external policies. Does the USA have the appetite or even financial resources to remain the Global Policemen? USA reduction of its public and even commercial presence, influence and resources externally may accelerate de-dollarisation. However, subject to extreme events in the form of a World War or similar cataclysmic event rapid de-dollarization is unlikely especially as the U.S. has a long-standing global network of alliances and partnerships.

A gradual acceleration in de-dollarisation is more likely, though a tipping point may be reached when the USA has to consider how to service its enormous debt (currently $34 trillion), which would be triggered by higher reductions foreign holdings of US Treasury Securities and US$ Deposits. That will not occur in 2024 but world events will no doubt be monitored by the US Administration and US Federal Reserve. For signs of reductions in foreign holdings of US Treasury. Equally, future US Administrations may be more judicious in their use of trade sanctions which could precipitate reductions in foreign holdings of US Debt.

For the foreseeable future to diversification is the name of the game. Other currencies and their public debt will form a growing element of global foreign currency reserves. The US dollar remains the de facto currency for the world’s biggest and most liquid financial markets, including the largest stock and bond markets global. No one currency is vying to assume the role of US dollar as the global reserve currency. Alternatives to replace the dollar anytime soon are aspirational at best. For example, the Chinese Renminbi represents a very small share of global trade. Its capital account remains closed due to restrictions placed on it by China’s government to avoid external speculation.

For now the US dollar remains the de facto currency used within the world’s dominant payment network, SWIFT, comprising 11,000 member institutions across 200 nations and territories and carries out more than 42 million transactions per day worth a daily average of almost $5 trillion.

Bob McDowall

January 2024