Smart Centres Index

Instrumental Factors

The Smart Centres Index (SCI) is built using a range of instrumental factors. In selecting factors to compile the SCI, a number of key properties are essential:

- Time series – where possible we will seek data that is contemporary (published within the last three years) is part of a series (collected as part of a programme rather than as a one off) and is on-going (there are plans to update it in the future).

- Locational relevance – where possible we will seek data at a jurisdictional level. Where this is not possible we use appropriate apportionment rules and/or alternative data, i.e. country or regional.

- Accessibility – data should generally be publicly accessible, this enables transparency in the assessments.

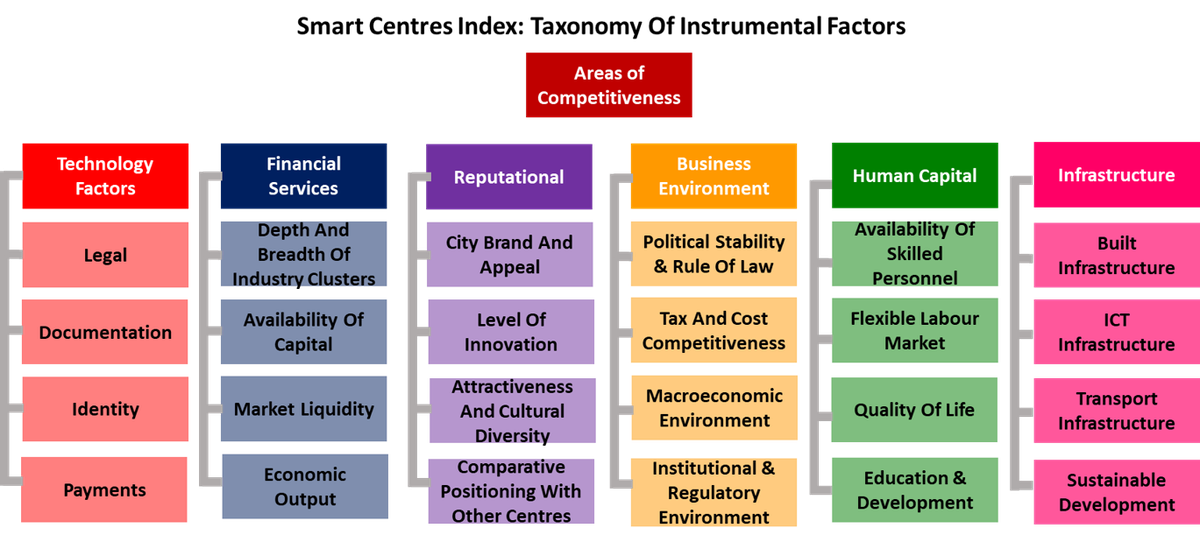

This edition of Smart Centres Index (SCI) used 136 instrumental factors. We have grouped the factors into the following areas:

Base Factors

- The Business Environment: Economics statistics and information on the ease of doing business;

- Reputational: Statistics on the quality and openness of life;

- Infrastructure: These focus on the physical attributes of centres such as telecommunications, real-estate and transport;

- Human Capital: These include data on education, employment, crime, corruption and health;

- Financial Services: Data on the state of financial service development and the value of trade and commerce;

- Technology Factors

- Legal: Measures focused on the legal status of smart technology use;

- Documentation: Sources tracking the use of smart technology for the delivery of services;

- Identity: These are measures focused on the maturity of e-government for identity and citizenship;

- Payments: The level of use of cryptocurrencies for payments and banking.

The taxonomy of factors is represented in the following diagram.

The factors used in the SCI are set out below:

The World Bank: Real Interest Rate

AT Kearney: Global Services Location

Transparency International: Corruption Perception Index

PWC: Corporate Tax Rates

OECD: Personal Tax Rates

The World Bank: Tax Revenue as Percentage of GDP

Fraser Institute: Economic Freedom of the World

IMF: Government Debt as % of GDP

OECD: OECD Country Risk Classification

Institute for Economics & Peace: Global Peace Index

Tax Justice Network: Financial Secrecy Index

The World Bank: Government Effectiveness

World Justice Project: Open Government

World Justice Project: Regulatory Enforcement

Reporters Without Borders (RSF): Press Freedom Index

Swiss Association for Standardization (SNV): Currencies

The Commonwealth: Commonwealth Countries

CIA: Common Law Countries

The World Bank: Inflation, GDP Deflator

The World Bank: Rule of Law

The World Bank: Political Stability and Absence of Violence/Terrorism

The World Bank: Regulatory Quality

The World Bank: Control of Corruption

International Budget Partnership: Open Budget Survey

Enerdata Statistical Yearbook: Refined Oil Products Production

TMF Group: Global Business Complexity Index

ICTD: Number of Tax Treaties

IMD: World Competitiveness Scoreboard

UNCTAD: Foreign Direct Investment Inflows

The World Bank: GDP per Person Employed(constant 2017 PPP $)

WIPO: Global Innovation Index

U.S. Chamber of Commerce: International IP Index

The Economist: RPI (% change on year ago)

ICCA: Number of Meetings

2ThinkNow: Innovation Cities Global Index

The Economist: Big Mac Index

Boston Consulting Group: Sustainable Economic Development

Freedom House: Level of Internet Freedom

Good Country Party: Good Country Index

Legatum Institute: Legatum Prosperity Index

UNCTAD: FDI Inward Stock (in million dollars)

The Mori Memorial Foundation: Global Power City Index

The Heritage Foundation: Economic Freedom

The Economist: Safe Cities Index

Dual Citizen: The Global Green Economy Index

Agility: Agility Emerging Markets Logistics Index

Jones Lang LaSalle: JLL Real Estate Transparency Index

World Energy Council: Energy Sustainability Index

Yale University: Environmental Performance Index

Solability: Global Sustainable Competitiveness Index

The World Bank: Logistics Performance Index

WHO: Proportion of population using safely-managed drinking-water services (%)

INRIX: INRIX Traffic Scorecard

World Bank: Forestry Area

Open Signal: Global Reliability Experience Report

World Bank: CO2 Emissions Per Capita

Enerdata Statistical Yearbook: Share Of Wind And Solar In Electricity Production

Enerdata Statistical Yearbook: Energy Intensity Of GDP

Enerdata Statistical Yearbook: Share Of Renewables In Electricity Production

World Economic Forum: Energy Transition Index

Oliver Wyman: Urban Mobility Readiness Index

MIT Technology Review: The Green Future Index

The World Federation of Stock Exchanges: Capitalisation of Stock Exchanges

The World Federation of Stock Exchanges: Value of Share Trading

The World Federation of Stock Exchanges: Volume of Share Trading

The World Federation of Stock Exchanges: Broad Stock Index Levels

The World Federation of Stock Exchanges: Value of Bond Trading

The World Bank: Domestic Credit to private sector (% of GDP)

The World Bank: Percentage of Firms Using Banks to Finance Investment

Investment Company Institute: Total Net Assets of Regulated Open-End Funds

Islamic Banks and Financial Institutions: Islamic Finance Country Index

The Bank for International Settlements: Net External Positions of Banks

The Bank for International Settlements: External Positions of Central Banks as a share of GDP

The World Bank: Liner Shipping Connectivity Index

DHL: Global Connectedness Index

UN Sustainable Stock Exchange Initiative: Sustainable Stock Exchanges (Y/N)

CBI: Green Bond Segments On Stock Exchanges (Y/N)

Z/Yen Group: The Global Green Finance Index

Z/Yen Group: The Global Financial Centres Index

Climate Bonds: Sovereign Green Bond

The World Bank: Gross Tertiary Graduation Ratio

Henley Partners: Henley Passport Index

UN Development Programme: Human Development Index

Numbeo: Purchasing Power Index

Capgemini: Number of High Net Worth Individuals

UN Office of Drugs & Crime: Homicide Rates

The World Bank: Average precipitation in depth (mm per year)

Coursera: Global Skills Index

Institute for Economics & Peace: Global Terrorism Index

The World Bank: Adjusted net national income per capita

OECD: Household net financial wealth

The World Bank: Educational attainment, at least Bachelor's or equivalent, population 25+, total (%)

The World Bank: Life expectancy at birth, total

OECD: Employees working very long hours

Cato Institute: Human Freedom Index

Nuclear Threat Initiative, Johns Hopkins Center for Health Security, and Economist Impact: Global Health Security Index

Education First: English Proficiency

United Nations: E-Government Development Index

United Nations: E-participation Index

United Nations: UN International Sale Of Goods

OECD: Digital Government Index

International Organization for Standardization: ISO TC307 Participation

Comparitech: Internet Censorship Rank

Coin Dance: Volume Of Bitcoin Trades

Coin Dance: Legal Status Of Bitcoin

Tortoise Media: Global AI Index

Z/Yen Group: GFCI FinTech Index

Findexable: The Global Fintech Index

ITU: Global Cybersecurity Index

United Nations: Telecommunication Infrastructure Index

Global Index on Responsible AI: Global Index on Responsible AI

StartupBlink: Global Startup Ecosystem Index

Cable: Worldwide Broadband Speed League

IMD: Smart City Index

The World Bank: Patent applications, residents

Dappros: Worldwide Blockchain Developers Statistics

Dappros: Worldwide Web3 Developers Statistics

Coincub: Blockchain patents by country

Coincub: Global Crypto Ranking

ChainAnalysis: Global Crypto Adoption Index

IMD: Technological Infrastructure

IMD: Scientific Infrastructure

IMD: World Digital Competitiveness Ranking

WIPO: Knowledge and technology outputs

WIPO: Creative outputs

Blockspot.io: Blockchain Activity

PWC: Global Crypto Regulation Report

Oxford Insights: Government AI Readiness Index

IBM: IBM Global AI Adoption Index

Ookla: Speedtest Global Index - Fixed Broadband

Ookla: Speedtest Global Index - Mobile

Innovate UK: TFAD Global Regulation Index