Reflections On Engines & Economies

Tuesday, 09 June 2020By Robert Hercock

Abstract

If you approached the Earth from deep space, on the night side, what would you see? A filigree lattice of lights spanning the continents, in particular, the lights are draped along the coastal regions like pale confetti.

If you were not of Earth, you may rightly conclude that these artificial lights represent the primary evidence of intelligent life on the planet, i.e. cities and towns. In contrast, you would struggle to see any direct evidence of countries or companies (zoom in sufficiently and you may just see the new Apple doughnut shaped HQ). Why then do we obsess with defining our economic systems in terms of nation-states and corporate entities?

A source of inspiration we shall return to throughout this essay, is the research work of Prof. Geoffrey West [1,2], whose seminal work on Scaling laws, as applied to the dynamics of company and city development, deserves wider attention.

The average company only lives for ten years- even large corporates perish after approximately four decades. A company that hits its 100th birthday has done rather well indeed. And, yet the cities of London or Paris, Rome or Beijing, have existed for millennia.

Post Covid-19, we should, therefore, refocus our attention on what makes for prosperous cities and towns. These are the real engines of long-term economic development; not the in-vogue digital giants, nor even the elder denizens of industry, e.g. Mercedes, GE, BP or Sony. These commercial entities will all be historical footnotes within a single human lifespan. This essay aims to convey why cities matter, and argues for a radical new approach to macro-economic planning as we enter a brave new post-pandemic world. It really is time to try some new ideas.

Introduction

The basis for modern economic thinking revolves around the distribution of labour and capital [3][4], with central banks endlessly tweaking interest rates in a forlorn attempt to conjure growth from the ether of business activity. However, any large economy is better modeled as a complex adaptive system of competing agents. Hence crude adjustment of the basic parameters of capital flows and interest rates will likely fail to capture the broad spectrum of potential economic behaviours [5].

Returning to the space theme we started from, the following section will discuss how we might think of the economy using a rocket engine as a metaphor.

Rocket Science

As I write this piece, Space X has just launched its first manned flight with the Dragon capsule, sending two astronauts to the International Space Station. A milestone in the use of a private company spaceship to send humans into space. Any such rocket requires fuel and oxygen in exactly the right mixture to deliver thrust. In addition, it requires a spark to ignite the combustion sequence.

We may compare whole economies to the process of engine design: they need fuel (resources and labour), oxygen (capital), and most importantly a spark of innovation to kick-start the whole cycle of creation, distribution, and productive engagement. We typically possess some mixture of labour and capital in any given economy, what appears to be lacking, is real innovation. Hence the next question is where does innovation arise from? A potential answer to this lies in the emerging field of network dynamics [6].

Networks

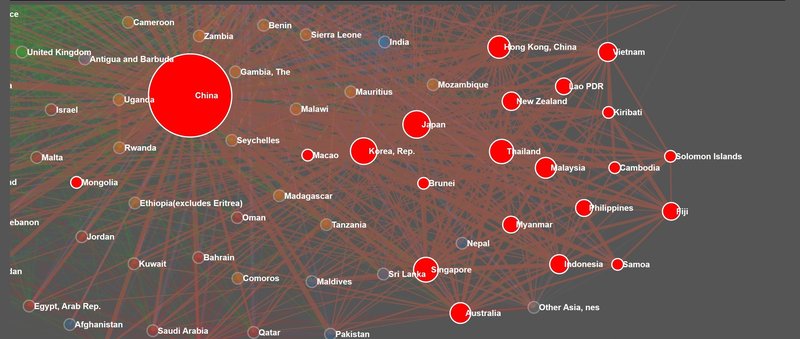

The referenced papers by Cezar Hidalgo [7] [8] are a useful introduction to how networks shape economics and the productivity of nations. I also highly recommend his TED talks to get a feel for the subject. His work closely intersects the research by Prof. West, in addressing the evolution of cities and urban economic models [9]. Figure 2 illustrates how a network visualisation of economic data can reveal patterns of interest.

One missing piece of the puzzle is how to design and architect cities and towns, in order to enhance their capacity as engines of creation and innovation. Clearly, individuals need a space in order to test and develop new ideas. Many new start-ups rent a slice of office space in a planned industrial district, but this is often expensive. A safer bet has been to use a domestic garage space. It is also a challenge to find the right space, if you want to build a new physical machine and not a web site.

Garage Argument

It has often been observed that many of the digital titans of the modern age had their origins in a humble domestic garage, e.g. Amazon, Microsoft, Google, Apple, Disney, Under Armour, Dell, Harley Davidson, and HP.

“In a 1998 interview, Bezos said, "I know why people move out of garages. It's not because they ran out of room. It's because they ran out of electric power. They have so many computers in the garage that circuit breakers kept flipping ... we couldn't plug in a vacuum cleaner, or a hair dryer anymore in the house.” [10]

(The author is qualified to comment on the subject, as he worked in a family business, in the 1980s, in a garage he built himself from scrap metal. It also ran out of power, as we dangerously overloaded the domestic wiring.)

This sounds like an obvious process, however, there are some challenges. Firstly, do you have access to a garage? Second, what kind of garage do you require? If you google this topic you will see the actual garages used by the above companies. Mostly, they are smart, large double-door garages attached to American suburban houses. With adequate power, (for a while), and flat concrete floors, plus coffee and toilets next door. Thus, an ideal space for a start-up company.

Unfortunately, that world is:

a. no longer available to many in the shrinking socio-economic space of the US middle classes, and;

b. completely lacking from most urban areas in the rest of the world.

Even in the UK, when a house has a garage, it is less than a third the size of a US garage- you really could not operate a business from one, beyond flower arranging.

Returning to the point, if you are running a city, or state, and seeking to create new companies that will flourish, then innovators need cheap and accessible space in which to invent, tinker and build. By cheap, I mean free. Also, don’t try applying commercial taxes on them in this phase, that’s another reason to start in a garage. Some attempts to drive this process have been formed, such as Maker spaces in the USA [11]. However, this really needs serious and funded commitment by policy makers world-wide. If you are seeking growth in productivity more garages are the answer. (Since the US sub-urban garage model is not globally viable, we need to find new alternatives that offer the same advantages for start-ups.)

Coffee Shops & Mail

A parallel line of thought, is where did the Enlightenment flourish? A short answer is in the coffee houses of 17th century Europe and America. They enabled entrepreneurs, scientists, inventors and investors to mix, socialise and receive postal mail. In the present age, coffee chains, such as Starbucks, have become the new social space, where people mix, receive email, and use them as low-cost hot desk spaces. A suggestion, just for consideration, lets mix coffee bars with Maker spaces and Artistic spaces. Plan urban development to include retail units that encompass all of these functions. The next question is where should you locate your new coffee & innovation units?

Clusters

Why do some regions succeed and many fail? Research on the historical evolution of cities by West, has shed light on their long-term innovation capability. It appears that, the most successful clusters in the present day have actually been centres of innovative thinking for centuries: for example, Cambridge UK and Boston in the US. A cluster centre must therefore be genuinely attractive, with one or more dynamic research-oriented universities. If people have been vacating a region over a pro-longed period, it’s highly unlikely to become a new cluster. You can force-feed such a region, but it will simply haemorrhage talent. Hence, identify regions that are attractive, but not yet economically dynamic and inject a mixture of capital, skills and economic incentives. And garages, with coffee somewhere nearby.

Diversity & Complexity

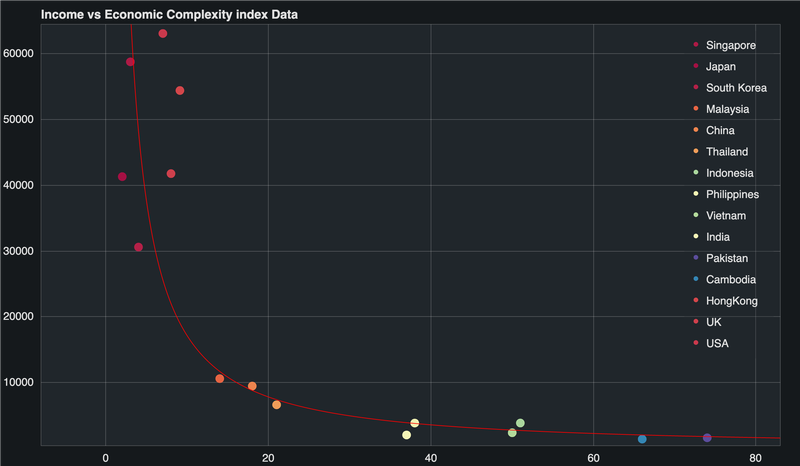

The second, and key point, is what kind of sectors should a state, or city, seek to encourage? The research by Cezar et al [8], strongly indicates that the best strategy is to drive for economic diversity. His measures of economic complexity (ECI) and its strong correlation with GDP per capita, indicates that greater diversity in an economy is one of the dominant factors for productivity and rising income. Figure 1, illustrates the point with data from a selection of countries, showing the relationship between ECI and mean Income. The data is a filtered set, as many resource rich states have a high income with a relatively low ECI value, e.g. Norway or Australia. Filtering these out allows a more useful consideration of whether ECI is a useful predictive measure of future economic development.

Figure 1. An example of how the Economic Complexity index impacts mean Income. The y-axis is the mean income in US dollars, while the x axis is the ECI value scaled from 100 (low diversity) to 1.0 (high diversity).

It is important to note this is a sampled data set, focused on Asia, as it appears to display a clear power-law relationship between ECI and mean Income. Using a broader sample of states and mean GDP in PPP terms, shows a fit closer to a log distribution [5]. However, there remains a distinct positive correlation between ECI and economic prosperity. More importantly, it is a non-linear relationship, meaning a small increase in ECI can have an amplified effect on mean income. For example, the state of Malaysia, (highlighted), sits at the inflection point of the curve, meaning a small additional increase in its ECI ranking would push it up the Income scale by a large amount.

Figure 2. A network illustrating the connectivity in export trade between states in Asia. (Data from World bank, 2016; node size scaled by percentage global export volume). See the referenced papers for a fuller discussion on this topic, which is beyond the scope of this essay, and requires a STEM education.

STEAM Engines & Invention

(Science Technology, Education, Arts and Mathematics)

The mantra most often repeated in policy circles and national institutions, is we need more STEM trained talent. This is certainly true. However, what we really need are new STEAM engines! This section will explore why combining Arts and Craft training within a traditional STEM syllabus, is vital to achieving the innovation and renewed productivity desired by society.

If we look at the beginning of modern technology, how did Richard Trevithick, transform the industrial age? The steam engine had existed since the late 18th century, (using low-pressure steam), but it was hopelessly inefficient in energy consumption and power output. It, therefore, burnt a lot of coal and couldn’t be used to build trains. Trevithick made the leap to utilising high-pressure steam, and in one stroke he transformed an existing crude technology into a world-transforming powerhouse. This was a creative leap of human imagination and an expression of pure engineering craftwork in action.

In contrast, our present education system stamps out students, who are forced at an early age into rigid pre-defined career paths. However, if you want inventors, they need the broadest possible education, including fine art and music. Invention is a craft process; it is an art in the purest sense of the word.

The epitome of the creative STEAM genius in the 20th century was the maverick thinker, Buckminster Fuller [https://www.bfi.org/about-fuller]. His life is truly worthy of study to understand how design, craft and science can be merged within one individual. His geodesic domes are the embodiment of skilled craft and design. He also had many failures, but his ideal was to truly benefit the whole of humankind:

“When I am working on a problem, I never think about beauty but when I have finished, if the solution is not beautiful, I know it is wrong.”

One quick way to measure the true innovation level of any organisation that pushes itself as innovative is to quietly inspect their workspaces. If it’s all pristine, clean, shiny, and well ordered, it is totally fake.

A truly innovative space is at least partially disordered, messy, complex and contains many non-obvious items, that appear to have no relevance to the primary goals. One example was the team at IDEO, who requested their management let them install a vintage aircraft wing above their workspace; as it inspired them [https://www.ideo.com]. It served no practical purpose, but it had an aesthetic appeal. Another example is to think of the laboratory run by Nikola Tesla, it exuded and embodied disorder. Creativity stems from disorder. Order is death. This issue sounds trivial, yet it is very challenging to make a business case that goes: “I want to make a mess and destroy things for a while, with no explainable outcome. It’s just a hunch.”

A specific example is, I have an idea for a radical new form of airship. I need a field, some hydrogen gas tanks, and non-flammable plastic. If anyone wishes to seed invest in the author setting fire to things, do let me know, (seriously).

In my personal research, I have filed a number of patents in data analytics, visualisation and AI. The project names I gave them have often stemmed from Impressionist painters, as these have inspired my craft, (i.e. Cezanne, Degas, or Monet). Translating data into meaningful visualisations, is part science, part storytelling, and requires some appreciation of colour palettes, light and shadow.

Furthermore, few individuals ever embody the passion of both a true inventor and possess cunning business acumen. The truth is you need a pair of individuals: consider the examples of: Wheatstone and Cooke, or Steve Wozniak and Steve Jobs.

When an inventor is left to fend for themselves, as in the case of Frank Whittle, or Charles Babbage, the result is often tragic, and the subject of future dramatic productions. A true inventor, cares for the art of creation and inventing; at the expense of mundane things like balance sheets and profit.

One of the greatest visionaries was Ada Lovelace, who accurately imagined the creative power inherent in computational systems, a century before they even existed 12. Her ability to translate the numeric computational machine, envisaged by Babbage, into something that could generate any pattern, was the highest form of human genius. Merging mathematics, technology and aesthetics; in her key paper she writes, the Engine “might act upon other things besides number... the Engine might compose elaborate and scientific pieces of music of any degree of complexity or extent”.

For creative souls, money is a distraction and unimportant. Vincent van Gogh is the epitome of this ethos from the art realm, where creation was the sole objective, and poverty merely an unfortunate side-effect.

As a state, trying to address this challenge, one clear hurdle is to effectively match-make between these two groups of people. If you can successfully engineer fruitful partnerships between the inventor and a sound business mind, you have a winning team. A state should, therefore, consider this in the design of new clusters, science parks, or institutions aimed at fostering innovation and productivity.

Innovation & Productivity

These two terms are perceived as the enabler and measure of future economic success by many states. The political historian Andrew Marr in his series on world history, rightly points out that Great Britain did not give birth to the industrial revolution because it had the best inventors and coal. Rather, because it had the right social and legal frameworks that allowed the inventive and entrepreneurial processes to flourish; compared to the authoritarian regimes that blighted many European states at that time.

In the UK at the present time, the level of productivity has been poor since the crash of 2007. A report by McKinsey highlights that this is partly due to excess product market regulation: “Despite the labor and capital market reforms of the past 20 years, output per capita in the market sector remains almost 40 percent behind that of the United States, and 20 percent behind that of West Germany.” [13]

I concur with their main result, i.e. “the main causes of low labor productivity are a lack of exposure to global best practices and low competitive intensity.” Many in the UK argue that low productivity is due to lack of training or skills, or lack of infrastructure investment [14]. These are also true, but the key issue is too few in the UK are willing to benchmark themselves against the global best. (A detailed report on the topic is available from the Parliament research office [15].)

Summary

The 18th and 19th centuries gave birth to the industrial age and the field of Economics, which was wrapped in the language of the age, i.e. stability, calculus, control and capital. However, that age also produced a tsunami of new art, music and architecture, with bold, organic design and imagery. We would benefit from an infusion of this artistic cultural well-spring, flowing into current economic models and policymaking. In particular, in the way we design and plan human settlements at all scales, needs to encompass the creative impulse in all human beings.

The side-effect of which will be enhanced economic growth and prosperity. But more importantly, it will be a sustainable growth and lead to resilient economies, that are far more resilient to boom-bust economic cycles; or endogenous shocks, such as pandemics. Commercial monocultures can be efficient, but they are intrinsically fragile in the face of shocks. The digital age has been hyper-productive because it released vast untapped creative potential. It has also been disruptive, but if we build on economic, (and social) diversity, then the waves of innovative disruption inherent in life, can be channelled and absorbed.

A central idea we reviewed is that we need new social processes to link inventors and business-oriented people. The current policy approach is inadequate, i.e. in hoping that enough magical individuals, with both skill sets, will arise and deliver the next generation of globe-spanning enterprises. Many members of society do have great ideas, and the creative capacity to invent. However, few have received sufficient business training, or have access to the high-risk capital required to translate the idea into action.

The modern industrial age was the fruitful child of inventive genius, craftwork and sharp business acumen. In the 20th century it sprang from garages in the suburbs of US cities, to deliver the digital age. In order for an economy to be productive, society has to allocate space and resources to mad folk. Many will fail. But the truly driven and possessed will deliver the next leap forward. As discussed earlier, this concept is echoed in the work by Cezar and Hausmann, where the clear gains from increasing economic diversity are apparent.

In conclusion, an economy is a living system, composed of an organic network of cities and human settlements, at all scales. In addition to a hyper-complex ecosystem of competing companies, SME and individuals. Building resilient and productive economies may not be rocket science, but at least we now possess powerful tools to help visualise, model, and understand their full complexity and dynamic nature.

References

- West G. (2011) TED talk on "The Surprising Maths Of Cities And Corporations" https://www.ted.com/talks/geoffrey_west_the_surprising_math_of_cities_and_corporations/transcript

- West G.(2018) “Scale: The Universal Laws of Life and Death in Organisms, Cities and Companies”, Paperback, May

- Keynes J M. (1936) “The General Theory of Employment, Interest and Money” https://www.files.ethz.ch/isn/125515/1366_KeynesTheoryofEmployment.pdf

- Smith A. (1776) “The Wealth of Nations, An Inquiry into the Nature and Causes of the Wealth of Nations” https://ibiblio.org/ml/libri/s/SmithA_WealthNations_p.pdf

- Hidalgo C., and Hausmann R., (2011) “The Network Structure of Economic Output”, Journal of Economic Growth, 16:309-342

- Bettencourt, L. M. A.; Lobo, J.; Helbing, D.; Kuhnert, C.; West, G. B. (2007) "Growth, innovation, scaling, and the pace of life in cities". Proceedings of the National Academy of Sciences. 104 (17): 7301–7306. Bibcode:2007PNAS.104.7301B

- Barabasi A., 2003. “Linked”, New York, Plume.

- Hidalgo C. (2010) “The value in the links: Networks and the evolution of organizations”, Center for International Development and Harvard Kennedy School, Harvard University

- Hidalgo C., and Hausmann R. (2009) “The building blocks of economic complexity”. Proceedings of the National Academy of Sciences of the United States of America, 106, 10570-10575

- Watts D., and Strogatz S. (1998) “Collective dynamics of 'small-world' networks”. Nature, 393, 440-442

- https://www.businessinsider.com/successful-companies-started-in-basements-garages-bedrooms-2020-4?r=US&IR=T#amazon-began-as-an-online-book-store-in-jeff-bezos-home-garage-1

- www.makerspaces.com

- Ada Lovelace (1842) "Sketch of the analytical engine Invented by Charles Babbage" http://www.fourmilab.ch/babbage/sketch.html

- https://www.mckinsey.com/featured-insights/europe/why-is-labor-productivity-in-the-united-kingdom-so-low

- https://www.theguardian.com/business/2020/feb/03/uk-productivity-slowdown-worst-since-industrial-revolution-study

- https://commonslibrary.parliament.uk/research-briefings/sn02791/

- https://www.weforum.org/agenda/2019/12/countries-ranked-by-their-economic-complexity