The Road To Serfdom: Biopiracy & The Ultimate Identity Theft

Monday, 26 November 2018By Ian O Angell

Money is at the root of it all. According to Professor Ken Minogue of the LSE: “the purpose of government is to raise money, to pay for government”1. Money itself is debt, instantiated as a ‘tax token’ that derives its perceived value from property rights. The notion of property is itself not that straightforward. Most of us think of ‘property’ as ‘things that belong to someone.’ Wrong! Property is a government-sanctioned monopoly right, which is legally enforced through their courts. This right may be: sold, licensed, mortgaged, assigned, transferred, given away, or even abandoned.

Government, and government alone, claim the right to signify ownership – but at a price. And once more we are back to money. Governments will preferentially bestow rights of ownership on those groups and individuals that generate the maximum revenue for the state. The ownership of property is all about raising money for the state; it has little, if anything, to do with any moral position.

So property is not ‘owned’ in the way it is commonly understood! ‘Ownership rights’ over assets are rented from the state (often in the form of taxes). This requires that some of these assets, or rather the government-guaranteed rights over assets (which includes labour), must be turned into property, monetized, and then rented or sold to cover debts. Either way, new debt is incurred somewhere in this system.

Government can seize assets through the courts at any time, simply by passing laws claiming ownership for itself, and possibly passing it on subsequently to others. Examples are ‘compulsory purchase’ in the UK, and ‘eminent domain’ in the US. However, governments cannot behave arbitrarily, because excessive seizure will limit the willingness of individuals to acquire property assets, undermining the viability of the whole system – a harsh lesson that is eventually learned by every socialist state.

Ordinary people are allowed free access to only a few crumbs from the property table – mostly what the owners are unaware of, or don’t know how to monetise yet. However, the moment the owners realise they have lost out from this giveaway, or they see a profit to be made elsewhere, then those crumbs are swiftly swept up. This is “The Theft of the Commons”. The ‘Commons’ originated in England and Wales with the notion of Common Land, namely a tract of land owned by a person, company, or the state, but over which other people (the commoners) may exercise certain traditional rights.

The Commons and private property can co-exist peacefully because of the compromises worked out over time – commoners find value in what the owners think worthless. For example collecting fallen sticks for firewood, or gleaning grain leftover from the harvest. However, problems arise whenever innovations (social, economic or technological) disrupt the status quo of the value system. Nowadays, the ‘Commons’ has come to mean assets that a community recognizes as being accessible to its members, including cultural as well as natural resources. This could include the notion of ‘fair use’ in the USA.

It is a popular misconception that the Commons is in some vague way owned by everyone, or at the very least by the community. That may have been the case a thousand years ago, but over the intervening years the rights of the ‘commoner’ have been increasingly eroded. A transfer of resources from the commons to purely private or state ownership is known as enclosure – or rather quaintly ‘inclosure’ in the UK. It is appropriate here to distinguish between state ownership and ownership by everybody. The Inclosure Acts in England, mostly from about 1750-1850 enclosed large areas of common, especially the arable land, meadows and the better pastures. By the 20th century, the only remaining commons in the UK were a few pastures, village greens, and rights of way.

The Commons is a renewable asset. However, it does require responsible and active use/management to remain viable; rights have to be carefully controlled to prevent the so-called tragedy of the commons2, where, through neglect or overuse, the resource becomes degraded from economic or demographic pressures.

From the fourteenth to the sixteenth century the rural population of England had declined both through plague, and from a slow drift to the towns. Lands were left in disrepair through lack of tenants. With their wealth under threat, landowners were forced into more efficient practices, whence the ‘owners’ solution of choice – enclosure, to facilitate sheep herding (that needed far fewer labourers than arable farming).

By the eighteenth century, a growing awareness of ‘Economics’ meant labour was seen as ‘property’ to be bought and sold, and as such a quantifiable economic entity. The market economy was emerging, no longer dominated by agriculture: the economic aim was no longer subsistence, but a marketable surplus. The notion of "common wealth" was being displaced by the "public good", and the Wealth of Nations, a la Adam Smith.

The landowners became rich, and many ordinary people were impoverished. The enclosure of common land was condemned as a huge swindle, driving many to violence and crime, as expressed in the popular poem from the eighteenth century:

They hang the man, and flog the woman,

That steals the goose from off the common;

But let the greater villain loose,

That steals the common from the goose.

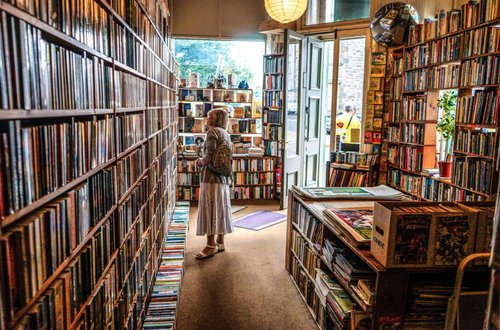

Does the notion of Commons have any relevance today? Of course it does! When we lend books, records or artworks to friends; or even sell the items second hand; or give them away as gifts, we are commoners exercising traditional rights over certain aspects of what is other people’s property, or even our own property. Gift tax is a form of enclosure. The Digital Age has brought with it numerous new forms of profitable enclosure. The rights that the book/record buying public, taken for granted for decades, are being eroded. We have the ludicrous situation where those who naively buy music legally have their usage severely constrained: they can neither share the music when it is in digital form, nor sell it on.

Until recently, such actions had only a marginal effect on the earning power of the ‘owners’ of copyright. Indeed previously, before we could lend, or give away copies, we had to buy the work in the first place. Now however, digital copies of works can be dematerialised, copied, shared, and given away ad nauseum. Some say the Internet has ushered in a whole new tragedy of the commons. Owners of copyright claim to have suffered serious financial loss. They have gone to government for protection and recompense, demanding new legal forms of enclosure (intellectual property rights (IPR)) to protect their property. And they can wield the double-edged sword of this technology, which can identify and spy on those who ‘steal’ intellectual property. Therefore privacy has become another common right that is ripe for enclosure. PCs are externally searched; limits are placed on the number of devices on which music can be played, or films watched.

Why do governments, even democratic ones, support such enclosures, preferring the rich few, to the many? Why? To create more debt, and consequently more money. However, don’t think this interrelationship is some form of government conspiracy – quite the contrary. It is a systemic consequence of the relationship between money and property. Money is a self-referential promise to repay a debt on property, with money raised from property! No one is in control; everyone involved is trapped, sleepwalking through an explosion of peculiar social and economic effects that emerge from the complexity in this system of money and property.

However, that system will collapse if too many people default on their loans, or if too many demand access to their money holdings, precipitating a run on the fractional reserve system of the banks. The 2008 financial meltdown is a case in point. It is only blind confidence (or is that ignorance?) that keeps this whole anti-gravity machine from crashing to earth. However, when it does crash, and inevitably it must, then panicked governments have to underwrite the banks with a call on future taxes, or with seized assets. The banks are “too big to fail”, because if they go then the whole financial system comes crashing down.

Only the time lag between borrowing, and repayment (in full plus interest) keeps this self-referential system of money afloat. But this requires the creation of new money in the interim, in order to pay the interest over and above inflation. This leads to an exponentially increasing scale of indebtedness. Consequently, the symbiosis between government, banks, and the preferred ‘owners’ of property (the rentiers) is not sufficient to keep the show on the road – it needs new energy to maintain the requisite exponential growth: it needs new money.

The monetisation of real estate, raw materials, food, and labour can only go so far. Indeed new innovations can render some property valueless. Beyond this, new assets have to be continuously created within the human value system. There is never enough old money around to fund the exponential growth, even when inflation is taken into account. Hence government is always on the lookout for innovators and entrepreneurs to facilitate the infusion of new debt, and thus new money.

The wishes of the two groups, old and new money, are often in conflict, with government acting as arbiter. The basis of that arbitration is not fairness or morality, but the rents that each group can offer to the state. Whenever the property behind old money becomes leveraged to its limit, and with it resulting diminishing returns, government will eventually renege on its partnership with the holders of old money, and switch its allegiance to the new, which can offer them a better deal. But only when it is clear that old money can no longer sustain itself.

In the early nineteenth century, landowners were the UK government’s ‘owners’ of choice, but a new and more powerful group was in the ascendancy: the industrialists. The turning point came in 1846 with the repeal of the Corn Laws. The Corn Laws were import tariffs introduced in 1804 to protect English corn growers from cheap foreign imports. Industrialists and the middle-classes had to pay higher wages just so their workers could afford to buy bread. The state was in effect subsidizing the landowners with industrialists’ money; until, with the Repeal, it changed sides.

Ultimately the state’s money supply depends on the total debt incurred when ‘owning’, purchasing or renting various property rights within its jurisdiction, which is why the state must guarantee that the majority of debtors repay their debts. This they achieve by intimidating debtors with the threat of legal action, and for which they rake off their cut in this extortion racket. The more assets that can be turned into property, the greater the debt, the greater the supply of money.

Government needs the new supply of money/debt, and they will support those who create it. Recently, governments’ insatiable demand for new money has led to intellectual assets becoming a major source of property. Intellectual property rights are becoming increasingly enclosed and monetized (is this today’s version of the Corn Laws?), adding to the debt mountain, all for the benefit of the state and preferential owners. Government commitment to upholding IPR means that litigation around IPR is becoming be a huge and ever-increasing overhead on every firm, every individual. Intellectual property rights are now a job creation scheme for lawyers.

To bamboozle the population so it doesn’t object to the loss of its common rights, the virtue of IPR legislation is justified in two ways: it is claimed that 1) the creators of works/inventions have a moral right to ownership; and 2) by promoting innovation and the creation of new works, society as a whole benefits. Utter bunkum! Neither of these justifications is self-evident, and possibly not even valid.

Thomas Jefferson thought that ideas should be spread freely for the good of mankind3. According to John Kay, “Historically, intellectual property has played only a minor role in the promotion of scientific innovation or creative effort.” It is arguable that Science would never have developed under an IPR regime. Indeed, scientists have become so concerned that Science is drowning in a sea of IPRs that a few have launched the Science Commons initiative, in an attempt to break down the growing barriers to research. Think back to 1955. Jonas Salk chose NOT to patent his polio vaccine. He said it ‘would be like patenting the sun.’ How the world has changed in sixty years!

As for business, Mercer and Kinsella argue that IPRs “are a burden to marketplace transactions, and discourage business start-ups.” Heller and Eisenberg say intellectual property rights are becoming so fragmented that, effectively, no one can take advantage of them, because it becomes impossible to track down all the holders. It is not uncommon for whole bundles of property rights to accrue to one single artefact. For example protecting the IPR of a movie means protecting the screenplay, musical score, performances, video recording, sound recording, broadcasts, and graphics etc. This unleashes a rash of negotiations before the final product can be bought, always assuming that all the owners can be traced. And worse, how can any company be sure that its latest innovative product won’t be compromised somewhere down the line by unresolved or unknown IPR issues?

Bottlenecks in the process of acquiring rights, such as not knowing where to go to buy them, ban the act of creativity from all but the chosen few. For example, every non-passive access of a work of art will be interpreted as the unauthorised use of someone else’s property – to be paid for. We are reaching a stage where paid permission will become increasingly expensive, making it available only to those with deep pockets. Back in 2008 the author wanted to illustrate his Black Hat talk with a total of 30 seconds from two Ella Fitzgerald songs. He was quoted a price of $750 US dollars for the performance rights – and decided not to bother. Even if the full cost of licensing is not made explicit, the general tendency is to assume the worst, and not to use a work. With no mechanism for easy access and sensible charging, this is nothing less than censorship.

And yet we are being told that IPR is good, positive; it means progress; it is fundamental to a company’s, a country’s economic well-being. The fundamental problem is that IPRs are "negative rights", in that they prohibit rather than permit. Large companies, that can afford the legal fees, use the threat of expensive litigation to stop others innovating. This can quickly become an anti-Trust, anti-competitive situation, where a cartel of favoured users takes unfair advantage.

New developments will be blocked: holders of old technology can buy up new patents, and kill off research; all the while continuing to profit from their old assets. The operating strategy of these "patent trolls" is to collect an IPR portfolio, and then sue all and sundry for infringements, while doing little to develop creativity and innovation.

It’s bad enough if the spread of IPRs doesn’t go any further. However, the implications are moving far beyond mere art, entertainment and engineering; each person’s very mind and body is now being enclosed: biopiracy has been made legal, hiding behind the cover of patent law. In September 1997, US company RiceTec patented "basmati rice lines and grains" (U.S. Patent No. 5,663,484) causing international outrage. Eventually RiceTec lost or withdrew most of its patent, including the right to call their rice lines "basmati". But how did it get this far? And losing one battle doesn’t mean losing the war.

John Moore from Seattle suffered from hairy-cell leukaemia, and in 1976 had his spleen removed by Dr. David Golde of the University of California Medical Center. Golde and his team subsequently extracted T-lymphocytes from the discarded spleen to establish a patented cell line, from which he generated substantial income.

Although Moore had signed the consent form, he claimed not to have been fully informed about the commercial potential of the cell line, and so he sued. The claim was rejected because he was not the inventor of the cell line, merely the original donor. The court concluded no patient could exercise property rights over discarded body tissue. The court was mindful that extending an individual’s property rights to include organs would restrict medical research. If laboratories have to check all the relevant property permissions on each and every sample from the large volume they use, their work would grind to a halt, and the state would lose out on this stream of revenue generation.

Hence the rights over this particular cell line were given to the researchers. The message here is loud and clear: the sole economic purpose of the population is to generate debt in order to keep the whole system going, and governments will be watching us all to ensure that we are paying our full wack.

The situation gets even more complicated when genetic material is involved, when say a particular gene mutation is shared by a family, or a community. This was the case of the Hagahai people of Papua New Guinea. Researchers discovered that some of the tribe carried a gene that predisposed them to leukaemia, but without manifesting any symptoms. Patents were sought from material harvested from a single individual. This raises fascinating issues of whether the consent of a single individual is sufficient when it relates to property that is common to many.

Be aware, we are moving rapidly in this direction of biopiracy. Big Brother is watching, and George Orwell’s ‘thought police’ are already walking among us. Given the functionality of modern surveillance technology, IPR owners will be widening their search patterns. Mobile phones give our exact positions away. Identity cards are next, and there will be no escape into anonymity. “They know who you are, and where you live.” Invasion of privacy is now the norm, so spies have the ability to uncover all unlicensed use of property. Microsoft, Google, and who knows what else is reporting back our every key-stroke. You’re very essence is being captured as a Data Profile.

However, all these scenarios pale into insignificance against the most extreme form of biopiracy: namely national identity cards supported by a data register. We are reaching a point where the state and major commercial interests are conspiring to enclose our identities to expand the money supply: the ultimate identity theft. The government and companies repeatedly warn us of identity theft by criminals, but then they themselves steal our identities.

Each record on the ID register will eventually take on a legal status. In a short time, all other proofs of identity will refer back to the one ‘true’ record. In effect, our identities won’t reside in the living flesh and blood of us, but in that one true legally legitimated record in the register.

Each identity can then be digitally enclosed, separated from the person, and turned into property – to be owned by others. All our money and property will de facto belong to the corresponding records in the register, and rights to that record will no longer be ours to decide. It no longer ‘belongs’ to us. Each of us will have legal access to our property only with the permission of the register. Money will then be transferred from our bank accounts whenever the bank is told to do so by the register – and the tax authorities will be first in line for this money.

It may start with identity cards, but soon the state will even try to convince us of the utility of embedding RFID chips in our bodies, just like we do with our pets. No more identity cards, no more passports, no cash. Physical presence alone (or rather the presence of an RFID chip) will suffice as a credit/identity card. Just like it was foreseen in the Book of Revelations, Chapter 13, verses 16-18.

16 And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads:

17 And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.

18 Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is six hundred threescore and six.

The state is the beast, and its number is 666, the symbol of everything evil. Society will be turned into a Panopticon prison, where the H.M. Revenue/IRS can, not only calculate every tax bill, but also seize payment. Friedrich von Hayek warned us: this is “The complete delivery of the individual to the tyranny of the state, the final suppression of all means of escape not merely for the rich, but for everybody”?

Then we can expect ‘differential rights’ for ‘differentiated citizens’, identified in a data-base and policed by smart ID cards. Party members, will use the card to gorge on benefits – euphemistically called entitlements, while opponents, trapped by their Ahnenpass, are harassed, suppressed, and worse. How long before ‘Human Rights’ becomes as outdated as the “Divine Right of Kings’?

Paradoxically, we only agreed to register for convenience and in order to protect ourselves from ‘identity theft,’ but instead we find ourselves victim of the ultimate identity theft – the total loss of control over our identities. It ends with us needing permission from the state to do anything, and that permission will become increasingly expensive. With a government-run identity register, you must prove you are the person whose data is stored in the database; anyone falling foul of the inevitable false positives will become a non-person. Then, somebody other than you will own your identity, and they can reserve the rights to turn it into property and to monetize it.

There’s another word for this – slavery! That we elect our slave-masters, makes our democracy slavery none the less. Welcome to Hayek’s Road to Serfdom4: “a world of rapacious, state-aided ‘privatization’” of enclosed identity: the ultimate identity theft.

References

1 Mccourt, W & Minogue, M (2001)The Internationalization of Public Management: Reinventing the Third World State. Edward Elgar Publishing, Cheltenham

2 Hardin, G. (1968). The tragedy of the commons. Science, 162 (3859), 1243-1248.

3 Letter from Thomas Jefferson to Isaac McPherson 13 Aug. 1813 Writings 13:333--35

4 Hayek, Friedrich A. (1944), The Road to Serfdom, Routledge, London.